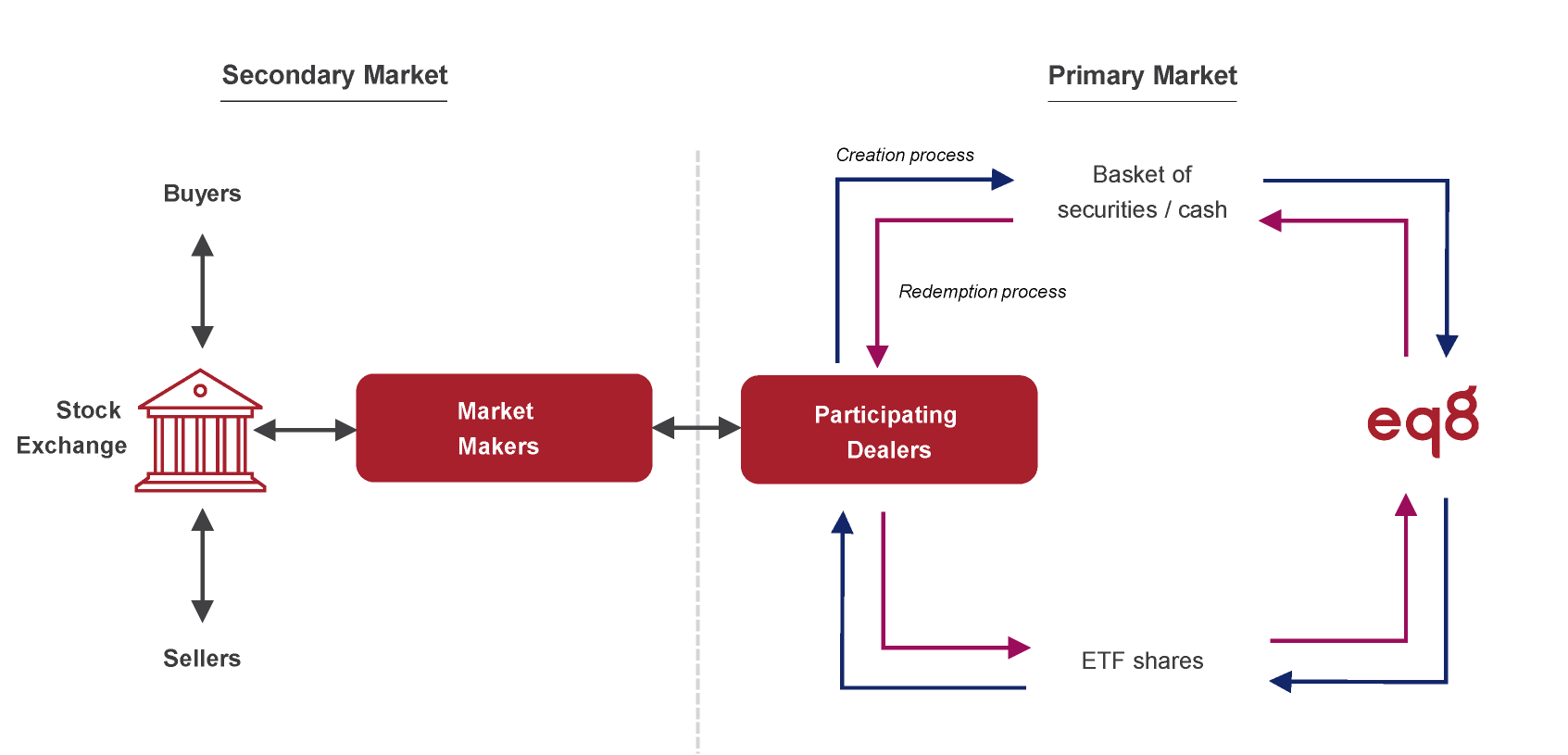

The ETF Manager is supported by Participating Dealers and Market Makers in ensuring the smooth tradability of the ETF.

A PD serves as a party appointed by the fund, facilitating the creation and redemption of ETF shares in the primary market.

The unique mechanism for creating and redeeming shares through a PD enables large transactions for institutions, wealth managers, and fund managers. In other words, institutional investors may buy ETF in bulk directly with PD that is close to the index performance at Net Asset Value.

Click here to learn more about investing through PD.

The MM plays a crucial role in facilitating a high volume of purchases and sales. They create liquidity in the market as they stand ready to execute trades at a publicly-quoted prices. Without them, each buyer would have to wait for a seller to match their orders.

The ETF Issuer, also commonly referred to as the Manager, is the fund management company responsible for establishing and managing the ETF. In this context, Eq8 Capital Sdn Bhd is the manager of the Eq8 ETF series listed on Bursa Malaysia.

If you were to individually purchase all top 50 Shariah-compliant stocks that make up the Eq8 Dow Jones US Titans 50, your broker would charge you a commission each time. These fees can accumulate rapidly and impact your overall returns.